Irs Expense Reimbursement Guidelines 2025. Gsa establishes the rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses incurred. An ordinary expense is one that is common and accepted in your trade or business.

A necessary expense is one that is helpful and appropriate for your business. This article discusses business expenses, the.

Gsa establishes the rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses incurred.

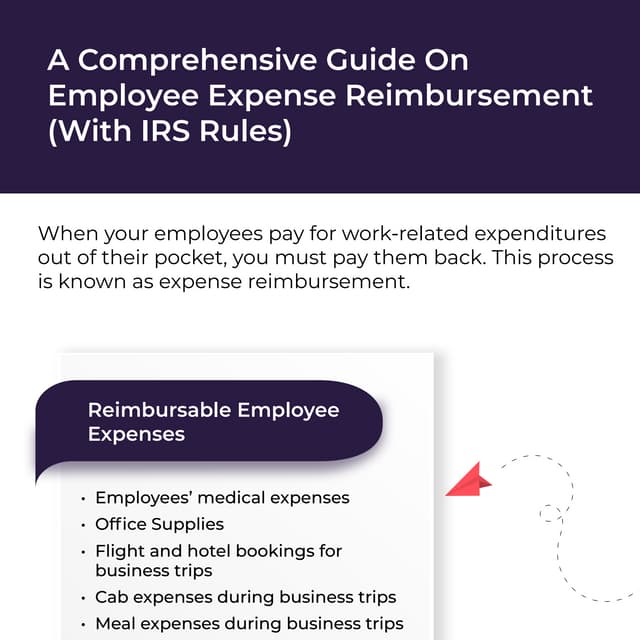

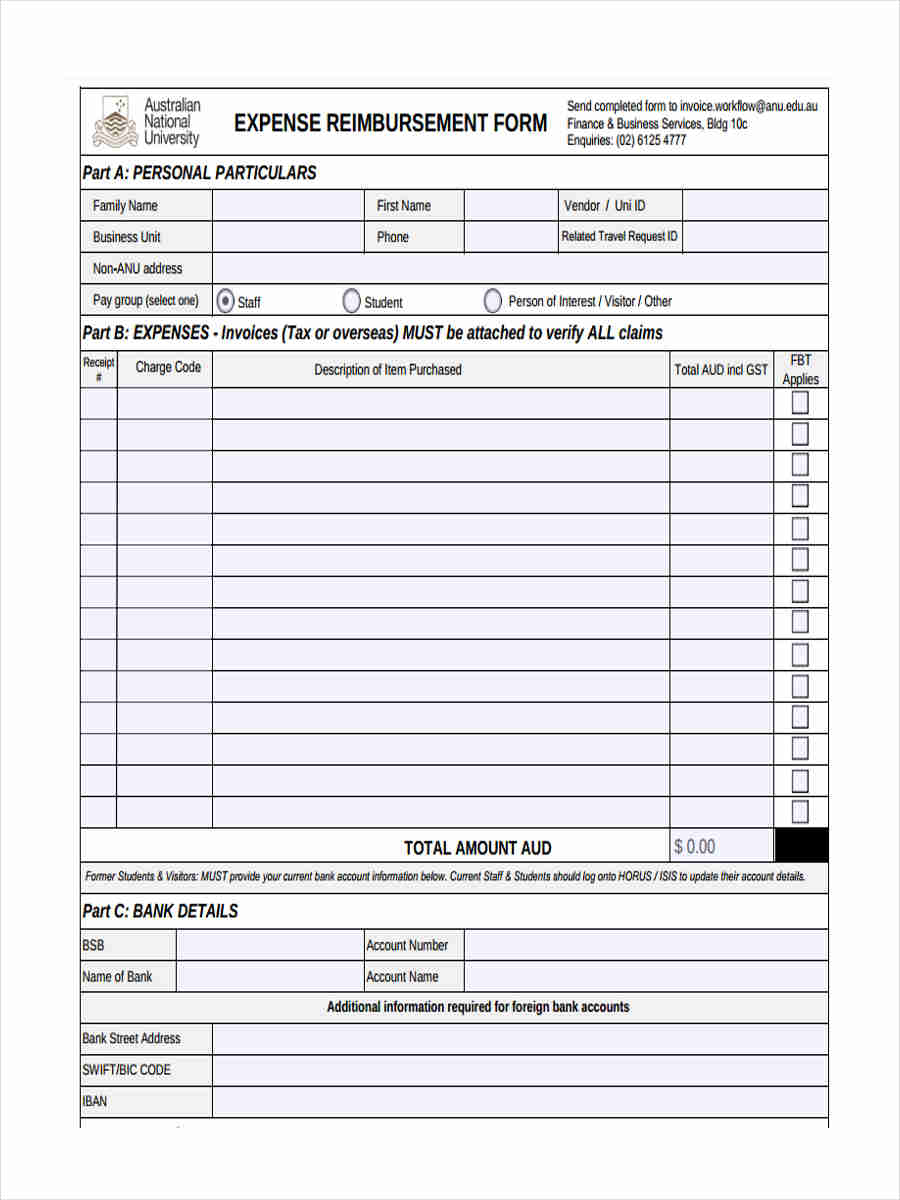

A Comprehensive Guide On Employee Expense Reimbursement, The irs provides guidance on employee expenses in guidelines such as topic 463: Whether or not you must withhold taxes depends on.

Guide Employee Expense Reimbursement with IRS Rules, The irs expense reimbursement guidelines have two types of plans: Whether or not you must withhold taxes depends on.

PPT IRS Accountable Plan For Expense Reimbursement Rules, If you use your car for business, charity, medical or moving purposes, you may be able to take a deduction based on the mileage used for. The irs provides 2025 expense reimbursement guidelines, and one area often discussed is the $75 receipt rule.

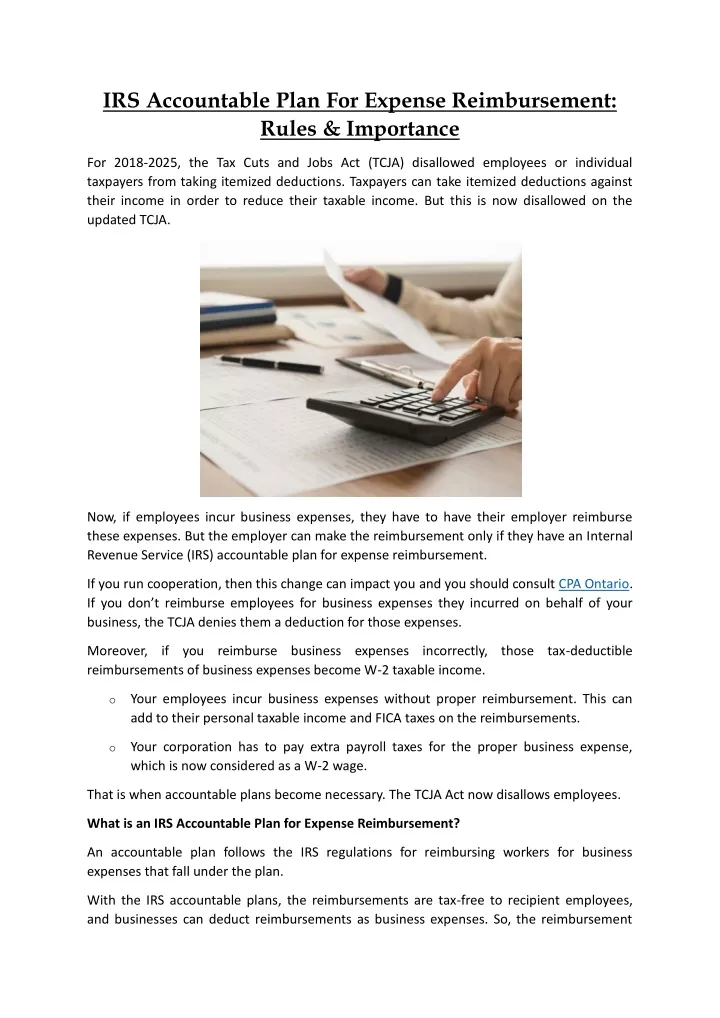

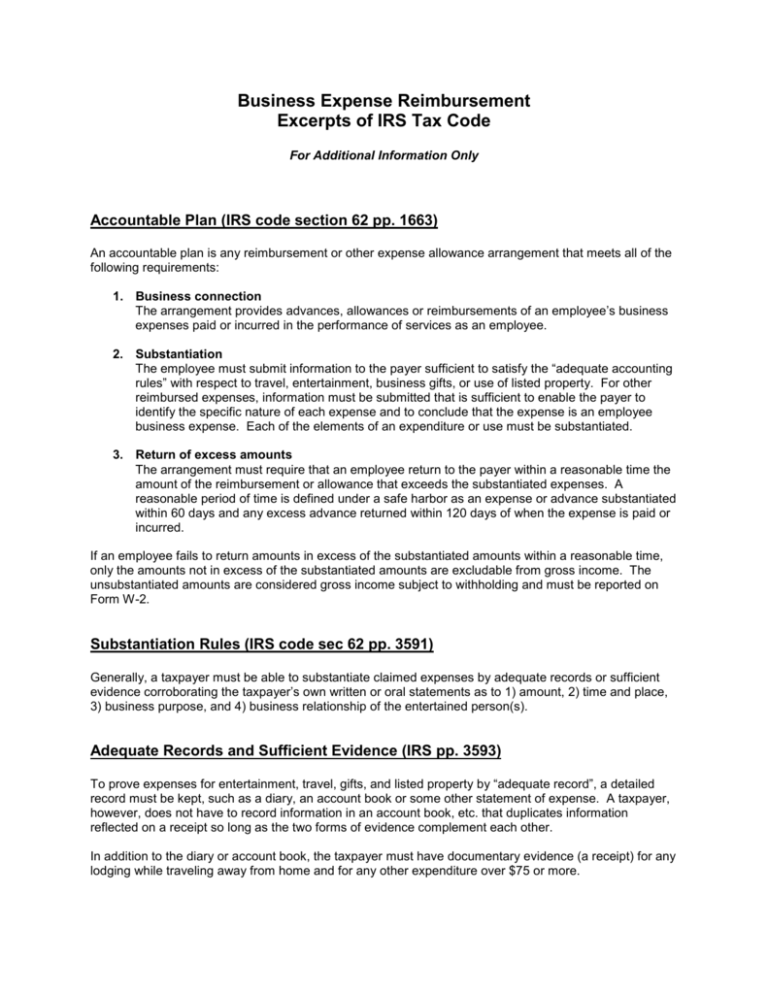

Is Your Expense Reimbursement Policy Compliant with IRS and, Suspension of qualified bicycle commuting reimbursement exclusion. The irs says expense reimbursement arrangements under accountable plans must follow these three rules:

Business Expense Reimbursement Excerpts of IRS Tax Code, Irs guidelines, contribution limits and eligible expenses. Washington — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may.

Expense AwesomeFinTech Blog, The expense must have a business connection. Irs guidelines, contribution limits and eligible expenses.

The IRS Rules for Premium Reimbursement Plans, If you use your car for business, charity, medical or moving purposes, you may be able to take a deduction based on the mileage used for. Irs guidelines, contribution limits and eligible expenses.

![IRS Business Expense Categories List [+Free Worksheet]](https://fitsmallbusiness.com/wp-content/uploads/2025/05/Thumbnail_IRS_Business_Expense_Categories_2025-730x508.jpg)

IRS Business Expense Categories List [+Free Worksheet], Employers typically set guidelines on what qualifies as a reimbursable expense, ensuring clarity and consistency in financial transactions between the. What is an irs accountable plan for expense reimbursement?

Irs Expense Reimbursement Guidelines 2025 Hanni Petronia, An irs accountable plan is a reimbursement system for business expenses that adhere to specific rules set by the internal revenue service (irs). This includes direct payments to movers or.

Employee Expense Reimbursement Definition, Taxes, Policy, The irs provides guidance on employee expenses in guidelines such as topic 463: Employers typically set guidelines on what qualifies as a reimbursable expense, ensuring clarity and consistency in financial transactions between the.

Employers typically set guidelines on what qualifies as a reimbursable expense, ensuring clarity and consistency in financial transactions between the.

Equipment Rental WordPress Theme By WP Elemento