2025 401k Limits Chart Gpt. 2025 simple ira and simple 401(k) contribution limits. The ira catch‑up contribution limit for individuals aged 50.

September 28, 2025 | last updated: The internal revenue service (irs) recently announced the 401 (k) contribution limits for 2025 as well as information regarding both traditional and.

The 2025 roth ira contribution limit is a crucial factor in retirement planning, particularly for single employees.

Irs Limit 2025 Winny Kariotta, For 2025, the contribution limit increases again to $23,000. For 2025, this limitation is increased to $53,000, up from $50,000.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, According to a statement issued by the irs, starting in 2025, employees can contribute up to $23,000 into their 401 (k), 403 (b), most 457 plans or the thrift savings plan for. The 401 (k) contribution limit could increase by $500 in 2025, according to new projections from mercer.

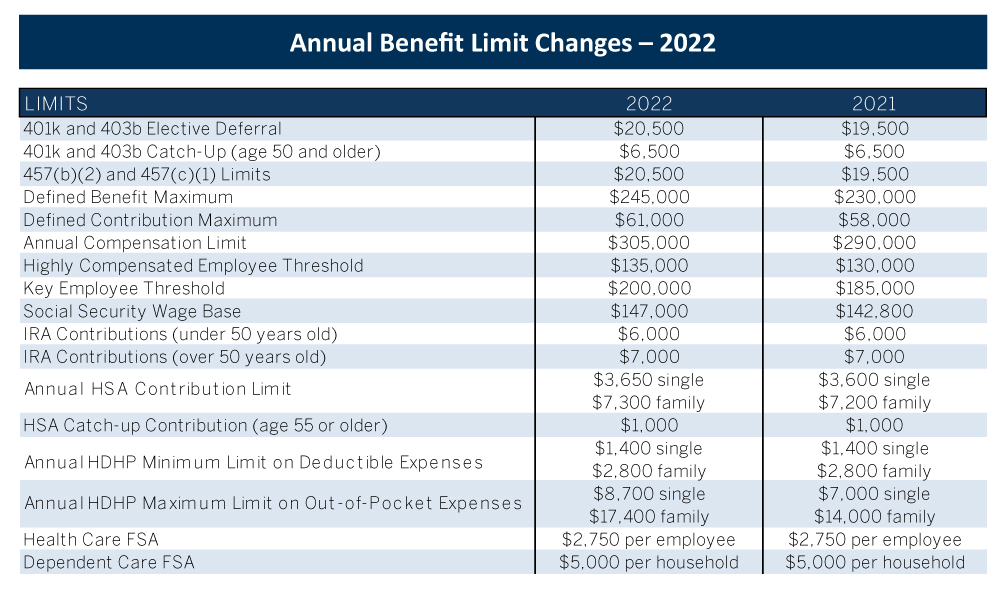

Retirement plan 415 limits Early Retirement, Here's how the 401(k) plan limits will change in 2025: Download a printable pdf highlights version of this chart.

New IRS Indexed Limits for 2025 Aegis Retirement Aegis Retirement, Here's how the 401(k) plan limits will change in 2025: 401 (k) pretax limit increases to $23,000.

401k 2025 contribution limit chart Choosing Your Gold IRA, The employee contribution limit for 401 (k) plans in 2025 has increased to $23,000, up from $22,500 for 2025. For 2025, this limitation is increased to $53,000, up from $50,000.

401k plan design checklist vicharonkamanch, For 2025, this limitation is increased to $53,000, up from $50,000. September 28, 2025 | last updated:

How The SECURE Act Changes Your Retirement Planning The Ugly Budget, The dollar limitations for retirement plans and certain other. The 401(k) contribution limit is $23,000.

401(k) Contribution Limits in 2025 Meld Financial, The employee contribution limit for 401 (k) plans in 2025 has increased to $23,000, up from $22,500 for 2025. For 2025, the contribution limit increases again to $23,000.

Lifting the Limits 401k Contribution Limits 2025, Other key limit increases include the following: 1 the $23,000 elective deferral limit.

self directed 401k contribution limits 2025 Choosing Your Gold IRA, The 401 (k) contribution limit for individuals has been increased to $23,000 for 2025. 2025 simple ira and simple 401(k) contribution limits.

401 (k) contribution limits should continue their upward climb in 2025, according to a recent projection by mercer.